In February 2023, Governor JB Pritzker announced his plans for Smart Start Illinois, a multi-year plan to provide every child with access to preschool, to increase funding for child care providers to raise wages and classroom quality, and to reach more vulnerable families with early support. Smart Start Illinois is a big next step in making Illinois the best place to raise children with a clear and ongoing commitment to children, families, teachers, and child care providers.

Through Smart Start Illinois, the state is poised to invest in Smart Start Workforce Grants that will help programs raise wages for personnel. The proposed Smart Start Workforce Grants program was informed by robust engagement of those working in and utilizing the system. View the pdf Community Engagement Report (5.72 MB) ( pdf Spanish (7.28 MB) ) to learn more about the community engagement effort.

Smart Start Workforce Grants FY26 Round 3 Applications are now open!

Use the quick links below to quickly find the Smart Start Workforce grant information.

Grant Eligibility | Orientation | How to Apply | Grant Schedule | Grant Award Amount | Classroom Elibigility | Wage Floor | Questions | Appeals Process | FY25 | Reporting Requirements

NEW Payment Options available for FY26!

pdf Visit this webpage in Spanish (569 KB)

What are Smart Start Workforce Grants?

Smart Start Workforce Grants offer child care programs stable, ongoing funds that they need to invest in quality staff without burdening families by raising tuition or Child Care Assistance Program (CCAP) co-pays. Eligible programs receive consistent funding in advance, and funds will cover the cost of higher wages and operating a classroom. Programs receiving these grants will be required to pay classroom staff a wage floor. These competitive wages will help to attract more staff and meet parents’ needs at a rate that they can afford.

Smart Start Workforce Grants are available for programs:

-

licensed as a child care center, family child care, or family group child care.

- licensed and caring for children by the first of the month prior to the opening of applications. For example, if the application opens on October 1, 2025, programs must be licensed, open, and caring for children by September 1, 2025.

-

that operate as a full-day, full-year program offering eight consecutive hours of care per day, five days per week, 47 weeks per year.

-

For centers - at least 15% of the program’s current licensed capacity (at time of application) enrolled and funded by CCAP in any one month in the year prior to submitting an application (e.g., any one month between January 2024 –date of application).

-

For family child care - care for at least 1 child and for family group child care 2 children enrolled and funded by CCAP in any one month in the year prior to submitting an application (e.g., any one month between January 2024 – the date of application).

-

other eligibility requirements may apply.

Eligible programs are required to:

- spend grant funds on staff wages only.

- pay teachers and assistants in grant funded classrooms at least the required wage floor.

- complete and upload quarterly payroll and wage documentation with reporting to show proof that the wage floor was met for teaching staff in grant funded classrooms.

- other requirements may apply.

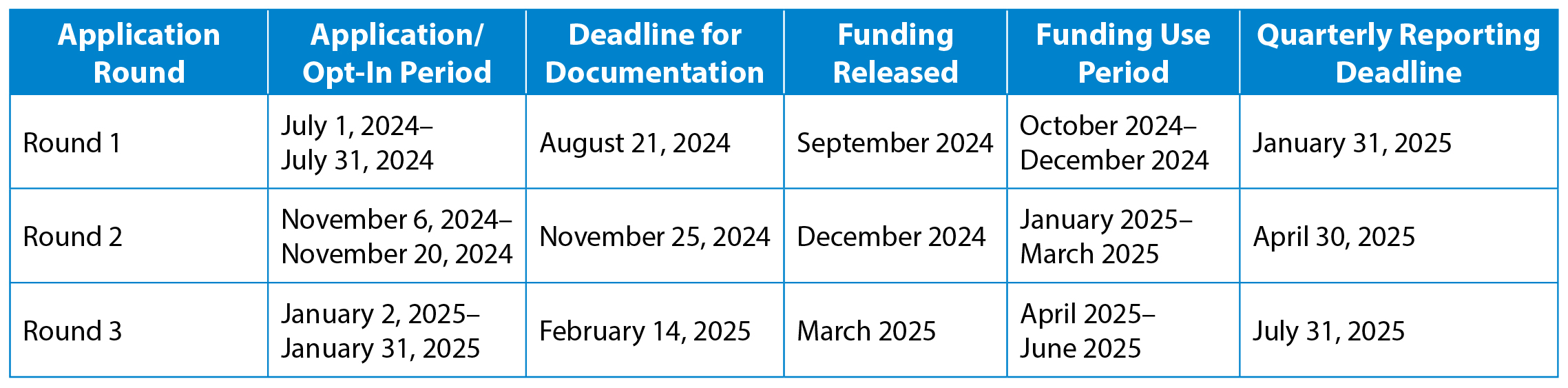

Fiscal Year 2026 Grant Schedule:

We are excited to announce the second year of Smart Start Workforce Grants, designed to provide stable, on-going funding for programs to invest in quality staff. In this new fiscal year, we are introducing important updates, including a required orientation and an expanded application schedule. Smart Start Workforce Grants will be offered across four rounds in Fiscal Year 2026. The schedule is as follows:

Please note in Round 1, your quarterly grant payment will be split into two payments. One will be sent in June, and a second payment with the remainder of the quarterly grant funding will be sent in July. This is to anticipate that at the beginning of a fiscal year funding might not be available starting July 1st. Smart Start Workforce Grants are taking steps to plan and provide funding to continue to pay the wage floor starting with payroll beginning July 1, 2025.

New Orientation Requirement:

As part of our commitment to ensuring all applicants are fully prepared, we are introducing a required orientation for the FY26 grant cycle. The orientation will have two versions, one for centers and one for family child care, both available in English and Spanish, and can be taken in two ways:

- In-person or Virtual (Live): Through your CCR&R (Child Care Resource & Referral) local expert. Contact your pdf Local Expert (1.04 MB) for scheduled dates.

- Virtually (Self-paced Online): Through i-learning.

As part of your grant application, you will list one grant contact for your program. The grant contact that you list is the individual that must take the required orientation.

Please ensure that you complete the orientation before applying for a Smart Start Workforce Grant. Orientation completion by the grant contact included on your application will be required and confirmed before processing your application. This will help ensure that all applicants are well-informed and ready to make the most of the opportunities available.

How to Apply:

Eligibility decisions for all new programs applying for a Smart Start Workforce Grant are determined based on funding availability. Grant applications are reviewed and placed on an eligible waitlist each round until the availability of funding can be confirmed.

Use the checklist below to ensure you have all the required documentation ready to go.

All applicants sign a Smart Start Workforce Grant Attestation confirming the information they provide is true and accurate, that they meet all required eligibility requirements, and they agree to meet the terms and conditions of the grant agreement. A submitted funding request is required to be eligible for grant funds each round as well.

The following items are required to complete a new Smart Start Workforce Grant application:

- Access to the Gateways Registry Director Portal

- Unique Entity ID

- Completed W9

- For centers, corporations, partnerships, and Limited Liability Companies (LLCs) – a current and valid Illinois Secretary of State Certificate of Good Standing

- For centers only – a site map, noting what rooms are used as classrooms

- Classroom rosters for all grant eligible classrooms – must include first initial, last initial, and age of child

- pdf Staff Listing (5.00 MB) - pdf Spanish (1.43 MB) must be up to date – verify all staff are listed and current

- Classrooms need to be entered to request funding for grant eligible classrooms for both pdf Centers (4.85 MB) - pdf Spanish (4.85 MB) and pdf Family Child Care programs (4.91 MB) - pdf Spanish (4.86 MB)

- pdf Smart Start Workforce Grants FY26 Attestation Round 3 (280 KB) - pdf Spanish (312 KB)

- A pdf funding request (340 KB) must be submitted by all programs to be approved for funding

- Make sure all reporting for any previous grants is complete and accepted. This will include Child Care Restoration Grants, Child Care Workforce Bonus, Strengthen and Grow Child Care Grants, Smart Start Transition Grants, and Smart Start Workforce Grants Round 1 and Round 2 reporting.

pdf

Smart Start Workforce Grants Flyer

(773 KB)

-

pdf

Spanish

(569 KB)

pdf

Smart Start Workforce Grants Application Tip Sheet

(2.44 MB)

-

pdf

Spanish

(3.27 MB)

Payment Options

Smart Start Workforce Grants and INCCRRA are excited to announce our new partnership with Blackbaud and REPAY to offer you more convenient and efficient payment options. As part of our commitment to drive efficiency and eliminate paper checks, we believe this initiative will enhance your experience with us.

REPAY will reach out to programs on our behalf to verify information and help enroll in the REPAY disbursement process. Programs should expect a call from them at 801-679-6044 or 801-762-8772, or an email from This email address is being protected from spambots. You need JavaScript enabled to view it..

We appreciate your cooperation in selecting your preferred payment method. Options include ACH/direct deposit, paper check or virtual credit card. If you are required to pay staff with grant funds, we highly encourage you to choose ACH/direct deposit or paper check. The virtual credit card will include a service fee and decrease the amount of your payment. If you do not respond to REPAY within two business days from their attempt to contact you, they will mail a paper check. Checks will mail from Chicago, Illinois.

Depending on your choice of payment method, you may need to provide additional documentation to REPAY. If you choose ACH/direct deposit you will be required to complete a DocuSign form. The DocuSign form must match what you submitted in your payment details screen under check payable to on your application (which also matches your IRS tax forms).

Grant Award Amount

Smart Start Workforce Grants will support center-based programs to increase wages for assistant teachers, teachers, and other program staff. Eligible programs will receive a grant award amount quarterly.

Center-based programs will be eligible for the following grant awards for each classroom:

Smart Start Workforce Grants will support family child care providers to increase their wages and their assistants’ wages. Family child care and family group child care will be eligible for a base award of $2,250 quarterly and additional funding if they have an assistant, based on the number of hours assistant(s) work.

Classroom Eligibility

Smart Start Workforce Grants are designed to support staffing in centers and family child care. Award amounts support staffing assumptions that meet or exceed licensing regulations. For Smart Start Workforce Grants, a classroom must contain a minimum number of children, determined by the age of children. These minimums are not a ratio like those in child care licensing regulations, nor are they required to maintain licensing with DCFS. Rather, these are conditions of the Smart Start Workforce Grant program.

*For Classrooms with children of multiple ages, the age of the youngest child in the classroom will be used for determining classroom minimum enrollment.

*For Classrooms with children of multiple ages, the age of the youngest child in the classroom will be used for determining classroom minimum enrollment.

- Classrooms must be funded by CCAP and/or private pay only.

- Classrooms must be full day, full year defined as a classroom that is open with children in attendance at least eight consecutive hours of care per day, five days per week, 47 weeks a year.

- Based on this classroom eligibility requirement, center school-age classrooms offering care before and after school, and on holidays and breaks would not be eligible.

- Center school-age classrooms with children over the age of 5 are not eligible.

Some programs may not be able to meet the classroom minimums due to their structure or a temporary drop in enrollment. To provide flexibility in these cases, Smart Start Workforce Grants will offer waivers from the minimum enrollment.

Programs may apply for a limited waiver or an annual waiver for classrooms that do not meet enrollment minimums.

Limited waivers: Programs requesting a waiver from the classroom enrollment minimum requirement due to low enrollment, lack of staff, or other reasons may request a waiver.

- Center programs: One waiver covers one classroom. Programs may be granted one waiver per classroom, with a maximum of three waivers in the first grant year.

- Family Child Care/ Family Group Child Care programs: Programs may be granted one waiver in a grant year.

- Programs granted a limited waiver will receive the same grant award amount per classroom.

Annual waivers: Programs requesting a waiver from the classroom enrollment minimum requirement due to limited space and capacity may request an annual waiver. Requesting programs must provide their DCFS licensing letter to demonstrate the licensed capacity for any classrooms requesting the annual waiver. If the DCFS licensing letter is not available, a statement from DCFS confirming the licensed capacity for the relevant classroom(s) will suffice.

- Center classrooms with annual waivers will receive a reduced award amount. For FY26, the reduced amount is $3,250 quarterly.

- Family Child Care/ Family Group Child Care programs with annual waivers are not eligible for assistance funding.

- The annual waiver option will be reviewed each fiscal year and programs will update the required documentation.

Wage Floor - Center-based program

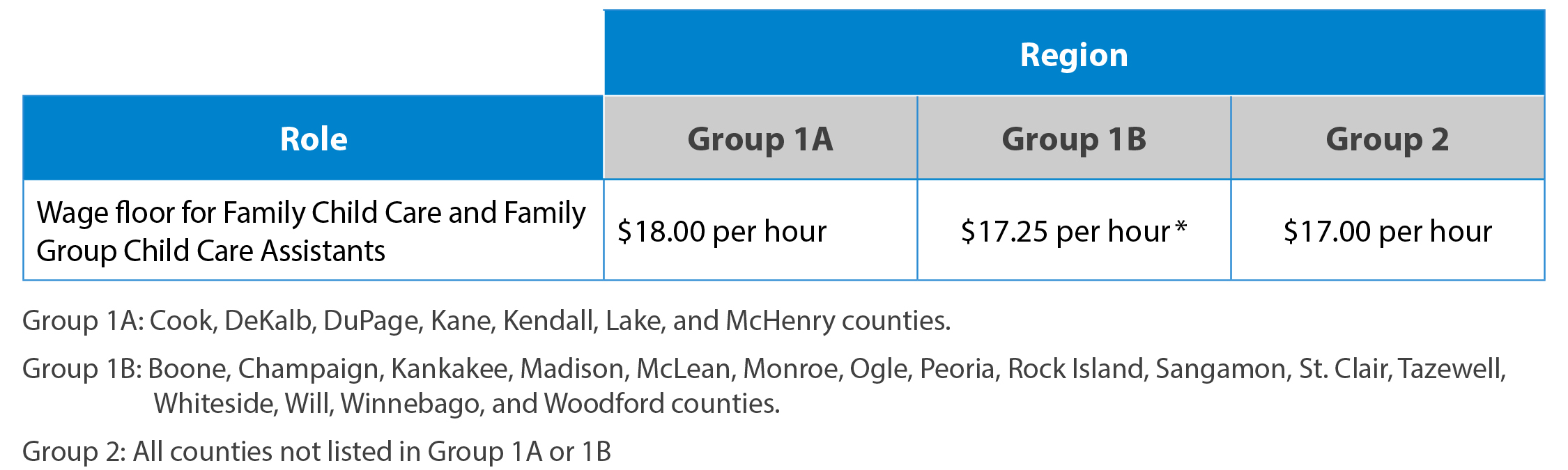

Programs that participate in Smart Start Workforce Grants will be required to pay teachers and assistant teachers in grant-funded classrooms a wage floor. A wage floor is a minimum required wage but is different from the legally required minimum wage. For Smart Start Workforce Grants, the wage floor is a requirement that programs agree to when they accept the grant. The wage floor varies by region, type of program, and role.

Wage Floor - Family Child Care based program

For Family Child Care and Family Group Child Care, the provider/owner will have discretion in the use of funds. However, if the provider employs an assistant, they must meet the required wage floor and recommend dedicating at least a percentage of funds to the provider/owner’s compensation.

As a grant recipient, programs will be required to display one or more Smart Start Workforce Grants posters in an area easily accessible to all classroom staff in participating classrooms. These posters will provide an overview of Smart Start Workforce Grants, the required wage floor for Teachers and Teacher Assistants, a section for programs to add their specific program and classroom names, and where to find more information about the required wage floor. The posters must remain visible in areas accessible to classroom staff throughout the entire grant funding period.

Have Questions?

The Illinois Network of Child Care Resource and Referral Agencies (INCCRRA) will administer the Smart Start Workforce Grants. INCCRRA will provide technical assistance answering technical questions and helping with the application process through its website and via email. Refer to the Smart Start Workforce Grants FAQs for both Centers and Family Child Care, to help answer your questions about Smart Start Workforce Grants. You can also email This email address is being protected from spambots. You need JavaScript enabled to view it. with questions.

- pdf Smart Start Workforce Grants - Licensed Child Care Centers FAQ (655 KB) - pdf Spanish (659 KB)

- pdf Smart Start Workforce Grants - Licensed Family Child Care and Family Group Child Care FAQ (706 KB) - pdf Spanish (757 KB)

New to Smart Start Workforce Grants is local technical assistance through the local Child Care Resource and Referral (CCR&R) System. This will provide local grant experts to provide technical assistance, and answer questions.

Smart Start Workforce Grants Appeals Process

New applicants for the Smart Start Workforce Grants have the right to appeal if they believe their ineligibility reasoning is incorrect or if their approved funding amount is incorrect. All appeals must be submitted by email to This email address is being protected from spambots. You need JavaScript enabled to view it. and must include a completed appeal form. Appeals should not be submitted until a program has received their official eligibility decision on their application (“Eligible (Waitlist)” or “Ineligible”). Applications still in a “Pending” status are still being reviewed and under consideration.

All Round 3 Appeals must be submitted by December 1, 2025.

- pdf Smart Start Workforce Grants FY26 Appeals Form Round 3 (105 KB) - pdf Spanish (108 KB)

- pdf Smart Start Workforce Grants FY26 Appeals Procedure Round 3 (101 KB) - pdf Spanish (103 KB)

Fiscal Year 2025 (FY25)

Smart Start Workforce Grants applications have closed for FY25. Below is information for reporting for FY25 grants.

Reporting Requirements

All programs receiving Smart Start Workforce Grants must complete reporting. Incomplete or incorrect reporting may delay acceptance and could impact future payment.

pdf Smart Start Workforce Grants Reporting Guide (551 KB) - pdf Spanish (569 KB)

The Smart Start Workforce Grants live reporting webinars have concluded. Please see below to access the recording and slides.

Centers:

- Recording Link

- pdf Smart Start Workforce Grants Reporting Webinar Slides (1.35 MB) - pdf Spanish (1.56 MB)

Family and Group Family Child Care - January 14th:

- English Recording Link

- Spanish Recording Link

- pdf Smart Start Workforce Grants - Family and Group Family Child Care - Reporting Webinar Slides (1.39 MB) - pdf Spanish (1.58 MB)

Family and Group Family Child Care - January 15th:

- English Recording Link

- Spanish Recording Link

- pdf Smart Start Workforce Grants - Family and Group Family Child Care - Reporting Webinar Slides (1.39 MB) - pdf Spanish (1.58 MB)

pdf

Sample Narrative Reporting Survey

(824 KB)

-

pdf

Spanish

(958 KB)

- Use this sample survey to help you prepare for the narrative reporting required for Smart Start Workforce Grants. This survey must be completed online, as part of your quarterly reporting.

Additional Resources to Prepare for Reporting:

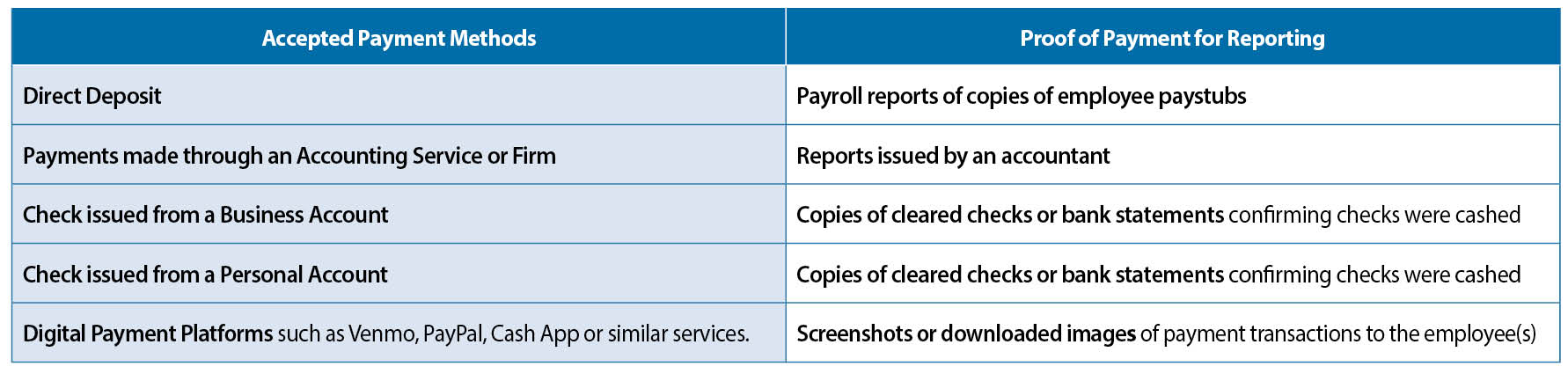

All participating Family and Family Group Child Care programs will be required to show proof that they paid their assistants at least the required wage floor, throughout the entire funding use period. See the linked tip sheets below for more information related to providing proof of meeting the wage floor. Cash payments are NOT allowed!

- pdf Smart Start Workforce Grants Meeting the Wage Floor - Family Child Care (198 KB) - pdf Spanish (199 KB)

- pdf Smart Start Workforce Grants Cash Payments (618 KB) - pdf Spanish (619 KB)

If you are a participating Family Child Care or Family Group Child Care with an assistant, you will need to provide proof that you met the required wage floor. For more information on key dates and reporting requirements, please refer to the tip sheets below.

- pdf Smart Start Workforce Grants Guide to Reporting - Family Child Care (672 KB) - pdf Spanish (686 KB)

- pdf Smart Start Workforce Grants Guide to Reporting - Centers (595 KB) - pdf Spanish (596 KB)

For further technical assistance around Smart Start Workforce Grants reporting and providing proof that your program met the wage floor, reach out to the Local Expert in your area: Local Expert Contact Map

FY26 Round 2 classroom posters must be displayed during the grant period months of October 1 – December 31, 2025. Click the links below to access and print the poster.

- pdf One classroom poster (Centers) (169 KB)

- pdf Multiple classroom posters (Centers) (170 KB)

- pdf Family Child Care classroom poster (172 KB)

Audits

All eligible grant programs will be audited at least once per grant year. Programs will be audited to verify wage floor, number of grant funded classrooms, and classroom enrollment. Audits could result in findings and a path to mitigate the finding may be offered. If mitigation is not complete, programs could lose grant funding and/or be asked to repay grant funding that was received. The audit will be conducted by INCCRRA audit staff and shared with IDHS.

Tip Sheets and Information Resources:

- Smart Start Workforce Grants Flyer - Spanish

- Community Engagement Report - Spanish

- UEI Tip Sheet - Spanish

- pdf Smart Start Workforce Grants Staff Listing Tip Sheet (5.00 MB) - pdf Spanish (1.43 MB)

- pdf Smart Start Workforce Grants Application Tip Sheet (2.44 MB) - pdf Spanish (3.27 MB)

- pdf Smart Start Workforce Grants Classroom Card Tip Sheet Centers (4.85 MB) - pdf Spanish (4.85 MB)

- pdf Smart Start Workforce Grants Classroom Card Tip Sheet Family Child Care (4.91 MB) - pdf Spanish (4.86 MB)

- pdf Smart Start Workforce Grants Funding Request Tip Sheet (340 KB) - pdf Spanish (1.48 MB)

- pdf Smart Start Workforce Grants Use of Funds - Centers (611 KB) - pdf Spanish (612 KB)

- pdf Smart Start Workforce Grants Use of Funds - Family Child Care (611 KB) - pdf Spanish (609 KB)

- pdf Smart Start Workforce Grants Instructions for Submitting Required Documentation (317 KB) - pdf Spanish (1.07 MB)

- pdf Smart Start Workforce Grants FY26 Attestation Round 3 (280 KB) - pdf Spanish (312 KB)

Smart Start Workforce Grants is pleased to offer additional resources aimed at supporting Illinois child care programs interested in leveraging grants. Developed by Civitas Strategies, these resources cover key topics pertinent to grant-funding, including:

- pdf Temporary Pay Increases (1013 KB) - pdf Spanish (116 KB) : This resource explores the advantages of utilizing grants to increase wages, offering strategies for child care providers to implement temporary pay increases effectively.

- pdf Pay Increases and Payroll Taxes (149 KB) - pdf Spanish (153 KB) : This resource clarifies how pay increases affect payroll taxes and outlines their implications for child care businesses.

- pdf Cash Flow (1.21 MB) - pdf Spanish (1.24 MB) : Through this guide, gain a better understanding of your business’s cash flow and how that may evolve with grant funding through practical exercises.

- pdf Tax Implications of Grant Funding (1.45 MB) - pdf Spanish (1.51 MB) : This resource outlines the tax considerations associated with receiving grant funding.

These resources are designed to empower child care providers by equipping them with the knowledge needed to maximize the impact of grants. For additional information, visit the “Taking Care of Business Blog” managed by Civitas Strategies, previously led by Tom Copeland.

Civitas Videos:

- Temporary Pay Increases Video - Spanish Video

- Pay Increases and Payroll Taxes Video - Spanish Video

- Cash Flow Video - Spanish Video

- Tax Implications of Grant Funding Video - Spanish Video

Smart Start Workforce Grant Dashboard

- FY25

- FY26